|

| “Nature’s great masterpiece, an elephant - the only harmless great thing.” - John Donne |

What is amazing to me is that these brokerage houses will not stand up and admit that they were flat wrong. In the last week, Goldman Sachs lowered their projection for recession in the U.S. over the next 12 months to 15%. I am not sure how useful this information is since their projection at the beginning of 2022 was 80%.

Bank of America only recently scrapped its forecast for a U.S. recession next year, indicating that now they do not think it is likely. The massive banks, Barclays and Citi, postponed the anticipated start of a mild recession downturn until next spring. I suppose if you keep postponing your projected recession date, everyone will eventually forget whether you were right or wrong.

|

| Ava, Dakota, and Joe with their new friend - for comparison, Joe is 6’4” |

I have several items to discuss in this posting, and I thought I would give some insight into our recent trip to Africa. I wanted to share all the beauty and exotic nature of that continent we witnessed. I will also discuss our economy, and current financial matters while reviewing why, once again it is highly unlikely that there will be a recession in 2023.

Before I delve deeper into those terribly interesting thoughts, I must report on the financial outcome for the month of August. As you know the year 2023 has been quite excellent for investing, and even though August fell off somewhat, it continues to be a vastly profitable financial year. The Standard and Poor’s Index of 500 stocks was down 1.6% in August but is up 18.7% for the year 2023 so far. Also, for the one-year period ending August 31st, that index is up 15.9%. The Dow Jones Industrial Average was down 2% for the month of August but is up 6.4% for the year 2023 and is up 12.6% for the one-year period ending August 31st. The NASDAQ Composite was down 2.1% for August but is up a sterling 34.8% in 2023 and is up 19.8% for the one-year period ending August 31st.

|

| A little chilly, but the view was worth it! |

I have been asked repeatedly why the so-called experts in the field of finance were so wrong about the U.S. falling into recession. I cannot help but think that a major reason for this failure to accurately forecast recession is that the financial system as a whole has changed. At one time, the entire American economy was dependent on the ability to borrow from banks and to use that cash in their operations.

|

| A sight to behold, indeed! |

There has been much said about the concept of people having extra savings, which I have also seen firsthand during business. After the flood of money, the government bestowed upon individuals during COVID, many are still living off these extra savings to ride out the economy. While it is true that unemployment went up from 3.5% to 3.8% last month, that had nothing to do with more people being laid off. For the first time in a long time, the actual number of people seeking employment went up in July which increases unemployment. With the number of people seeking employment being higher, the unemployment rate would clearly have to increase, but this is not a negative. Throughout this entire two-year period, employment has stayed enormously strong. Even to this day, employers are reporting that it is difficult to hire employees for any level of classification. Even my firm has suffered through long bouts of not being able to hire qualified employees to fill our positions.

|

| Josh and Carter checking out the Golden Gate Bridge. Did you know it took a little over 4 years to build it? |

The Wall Street Journal reported on Friday that home prices are rising again. The reason home prices continue to rise is scarcity. There are just not enough houses on the market for people to buy. It is true that interest rates and mortgages have reached a 22-year high, but most people who own a home and have locked in low rates years ago have no intention of selling and subjecting themselves to a higher rate. What we are seeing in Atlanta is that home ownership is more difficult because, for each home on the market, multiple offers are above the original listing price. It is hard to believe now, but the listing price is now only the beginning of the bidding war on the purchase of new housing.

So, what do we know about the economy now that we did not know before? As I mentioned in prior postings, all the evidence of the economy continues to be quite good. But what does the official record say? For the first quarter of 2023, the GDP was up a very satisfying 2%. In the second quarter of 2023, the GDP was up 2.4%. While we do not have the final numbers for the third quarter’s GDP, on September 8, 2023, the Atlanta Federal Reserve projected that the GDP for the 3rd quarter would be 5.6%. Wow!

|

| DeNay setting out to explore The Last Frontier |

For those of you who sit on the edge of your seat whenever there is an interest rate increase, just look at the prior two years. Even though the Federal Reserve has increased interest rates 13 times over this period, there has been almost zero effect on the economy and that is an exceptionally good thing. In the most recent announcement, we now have inflation starting to fall from last summer’s rate of 9.8% inflation to 3.2% inflation. The Federal Reserve has done an excellent job of bringing down inflation and creating an economy that continues to be strong.

|

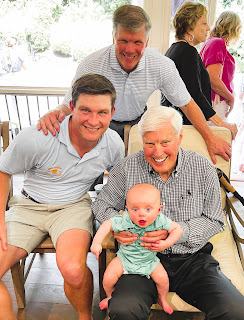

| Four generations of Battle boys – Bill, Pat, Will, and little Paul!! |

|

| A-weema-weh, A-weema-weh… |

Our first stop was Cape Town, where we spent three days. I found Cape Town to be uninteresting for the most part, particularly when one considers all the racial problems they have. While the end of Apartheid brought a close to institutionalized segregation, racial tensions did not end with it.

We did see some interesting sights and visited the Cape of Good Hope which was the most southwestern point of the African continent, but I was anxious to get to the jungles and see the animals. You may be familiar with the Cape of Good Hope and the legendary boat accidents that have occurred there due to the roughness of the water around the Cape. I can confirm that the water is extremely rough.

|

| “Cheese” |

The Big Five (lion, leopard, rhino, elephant, and African buffalo) were so named because they were the most difficult to hunt on foot. On our first day on safari at this location, we were able to witness all five of these animals and many more. I am not sure exactly what I was expecting when it came to the animals and their reactions to humans. We have all heard how protective a mother lion can be, but in one instance we were as close as 10 feet to one with her nine cubs and she was not concerned in the least about our presence.

|

| Not always a gentle giant! |

In the back of my mind, I was expecting we would be sleeping in tents without air conditioning and lacking necessities, but I was completely wrong. All the accommodations were 5-star hotels in the middle of nowhere, deep in the jungle. The first resort we stayed in only had 10 rooms and was situated in the middle of the jungle, such that we were not allowed to walk around the premises without an escort. The food was nothing short of extraordinary, even though it is difficult to focus on food when you have seen the jungle two times a day for a week.

|

| Patience is a virtue… |

At the Singita Lodge, we were able to see a lot of different animals that we did not see at the first resort. We saw a great many giraffes, hyenas, and wild dogs. Wild dogs are very difficult to locate since they move in packs and work mainly at night. But we were able to come across a group of about 10 as they were hunting.

We also came across three young male lions hunting buffalo along the plains. Once again, even though they were hunting for their food we were right beside them as they stalked buffalo. As the buffalo moved, we moved with them and followed them for several miles until it became too dark to follow them. The picture of these male lions, in my opinion, is quite extraordinary.

It was an amazing experience in every regard and one I had wanted to have for many years. It is not likely that I will return to South Africa, or Africa itself, but I just wanted to emphasize what a beautiful place it is and how pristine the area with wild animals is to see.

|

| Lucy, Jennifer, Harper et Eddie en balade à vélo à Paris! |

At some point during their retirement years, they will sell their principal residences and use some of that money to spend on travel and entertainment. However, if you think that money is illiquid, the bulk of it is in savings accounts and is believed to be worth $8.9 trillion in bank deposits and money market accounts alone. I bring up these facts just to illustrate that there is enormous spending power that has not been fully tapped. When it does, it will keep the economy going for many years to come.

|

| Long-time clients, Pat and Alice Anne Battle with their growing family: Mary Raines, Annie, Danielle, Will, and little Allie at the christening of William Paul Battle |

As we go into the last quarter of 2023, we need to be reminded that the best time in the stock market is November through May of any given year. Yes, August and September are volatile, but they mean nothing when building long-term wealth. Yes, a recession is unlikely any time soon, interest rates are likely to have topped out, inflation is clearly falling and getting better on a monthly basis, and corporate America continues to generate consistent and excellent profits.

There is nothing that I see that can bring down the market dramatically unless there is a geopolitical bend that none of us see. It is a shame we are all so focused on politics when it comes to money, but it cannot be avoided when it comes to a Presidential election year. I sense that even with the volatile August and September, the market has been great up to this point and is very likely to go higher before the end of the year. If you have not contributed to your IRA, now is the time to do it - and remember to make an IRA contribution every year.

|

| Proud mom Paula Herraiz with sons Blake and Mason – congratulations, Mason! |

As always, the foregoing includes my opinions, assumptions, and forecasts. It is perfectly possible that I am wrong.

Best Regards,

Joe Rollins

All investments carry a risk of loss, including the possible loss of principal. There is no assurance that any investment will be profitable.

This commentary contains forward-looking statements, which are provided to allow clients and potential clients the opportunity to understand our beliefs and opinions in respect of the future. These statements are not guarantees, and undue reliance should not be placed on them. Forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual results in future periods to differ materially from our expectations. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.

No comments:

Post a Comment