From the Desk of Joe Rollins

I know it is unbearably painful to watch the stock market negatively perform most days. However, for the 50 years that I have been invested, you can always rely on the fact that earnings and the economic environment will eventually return to the performance of the markets. That is where I feel we are today, and I want to point out some of those facts to you. In addition, I want to better explain the role of the Federal Reserve and the effect it is having on the current market. Lastly, I want to explain the extraordinary market performance we have had over the last 20 years and why pessimism at this level is certainly not warranted.

Before I go on to those more interesting subjects, I must report the performance of the markets for the month of September. It is unbelievable how bad the stock market performance was during that month. Not only were stocks down, but so were bonds, internationals, real estate, and virtually every other asset class you can name. What was interesting was that Fidelity’s lineup of sixty equity funds, which included some conservative funds, some midcap funds, and some aggressive funds, on average were down 9.2% for the month of September. By any standards, in any definition, it was an extraordinarily difficult move down for any one month. What was even worse for that quarter was all these funds were down 4.3% and the sixty equity funds were down 23.8% year-to-date. It just goes to show that there is nowhere to hide in this relentless selloff which is not supported by economic data.

The Standard and Poor’s Index of 500 Stocks was down 9.2% for the month of September and for the year down 23.9%. The 10-year performance on this index, including this down year, is 11.7%. The NASDAQ Composite Index was down 10.4% for September, down 32% for the 2022 year, and its 10-year performance is 14.2%. The Dow Jones Industrial Average was down 8.8% for the month of September and year-to-date is down 19.7%, but its 10-year performance is 10.4% annually. Just as a comparison, Bloomberg Barclays Aggregate Bond Index was down a stunning 4.3% for the month of September, is down 14.6% for the 2022 year, and its 10-year performance is 0.9% per year.

|

|

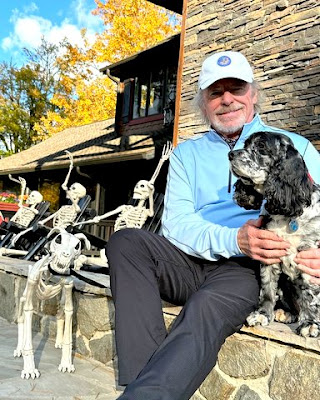

JRR sitting in JFK’s rocking chair

|

It is extraordinarily unusual when both stocks and bonds go down at the same time. If you had employed the 60/40 asset allocation, you would have suffered heavy losses so far in 2022. I am not trying to make a commentary on general performance, but it is quite unusual when virtually every asset class and every type of stock fund are all down during the same month. I am just not a believer that the millions of people that invest money suddenly decided that cash was better for the month of September.

The Federal Reserve was established to accomplish two major goals in the U.S. economy. The first was to maintain a stable economy which, by their definition, means inflation should be 2% not 8.5% as it is today. Their second mandate was to maintain full employment during good times and bad times. Neither of those mandates are more important than the other. Even though you have full employment and outrageous inflation, you are going to have an unstable economy. At 3.5% unemployment, we are in a very strong labor market. However, with 8.5% inflation, the Federal Reserve feels that it needs to take precautionary actions to reduce inflation.

The Federal Reserve of Atlanta has done a particularly good job in forecasting GDP going back over time. After reading all the negative commentaries in the news, you would assume that GDP would be a huge negative number for the third quarter of 2022. In reading the Yahoo headlines, virtually every other article was negative on the U.S. economy and how bad things are and how people cannot meet their monthly debts. The general sentiment from reading most of the editorial comments on the finances of Americans assumes that millions are out of work and underpaid and cannot meet their monthly household budget. Bread lines are surely next.

|

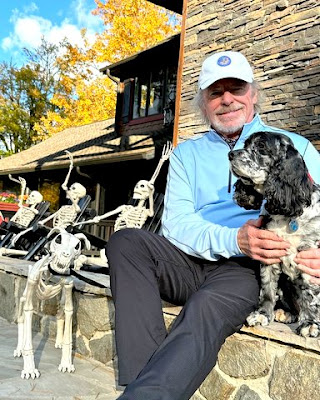

37-year client Allen Davidson & friends enjoying that

fresh NC mountain air |

However, if you actually read the data, nothing like that exists. The Federal Reserve of Atlanta is now forecasting GDP growth for the third quarter at 2.8%. Remember that the first two quarters of 2022 were marginally negative. This forecast assumes a major positive turn in the economy. Do you remember all the so-called experts forecasting recession in 2022? I guess they will have to wait another year.

Basically, if these estimates are correct, the U.S. is growing 2.8% in the third quarter with a 3.5% unemployment rate. Any country in the world would do handstands to have such excellent financial numbers, and yet we are facing a market that is down 23.9% year-to-date.

As for the unemployed, currently there are still two job openings for every one person that is unemployed in this country. There is absolutely no reason why anyone cannot get a job if they want one, since there are massive job openings. In addition, those workers that do have jobs have enjoyed a 5% increase in pay over the last year which, of course, adds to the inflation problem but allows those employees to meet their monthly obligations more easily.

|

| Client Janis Whitehead out on the town with husband John Jergel |

The major question now confronting the Federal Reserve is whether they have gone up too far too fast and have not given the economy an opportunity to absorb the rate increases. There is no question that the higher interest rates will start to affect housing prices at some point. However, let’s not put it out of context. In most housing markets in the United States, house values have gone up between 20% and 30% in the last few years. If these housing costs incurred a decline of a couple of percentage points, that hardly seems unreasonable given the sharp upturn. Higher interest rates obviously affect credit cards, car loans, and other types of financing vehicles. Once again, the incurring of credit card debt, new car loans, and other financing is optional to the average citizen and certainly avoidable if they desire to reduce spending.

The major obstacle in bringing down inflation will be reducing the cost of oil. Any number of rate increases will not reduce the price of oil but rather move the political needle more than interest rates. The formation of these large inflation increases began with the current Administration’s pledge to reduce oil production in the United States.

During the prior Administration, we enjoyed energy independence, but we are currently dependent on foreign oil which, in my opinion, is a huge mistake. By reducing drilling in the United States and regulatory overburden to the industry, basically the ripples of higher inflation were created at the beginning of 2021. At this point, overregulation and lack of permits has reduced drilling over the last couple of years, and exportation has taken a back seat. At the current time, there is absolutely no way to reduce the price of oil short of a change in regulatory authority out of Washington.

|

| Cecilia Cmeyla calling out of work from Disney World |

You can see the effect that it is having on the rest of the world. Recently, the Administration tried to lobby Saudi Arabia and the Middle Eastern countries not to cut production of current oil supplies. It was reported that they decided to cut production by one million barrels a day to increase prices. After strong arm negotiations by the United States Administration, Saudi Arabia, Kuwait, and the United Arab Emirates decided not to cut the production of one million barrels a day, but rather cut two million barrels a day. Oh well – so much for U.S. influence.

The Administration warned the Saudis that a decrease in production would impact the long-term future of the United States and the Middle Eastern countries. Clearly, their decision proves that the United States has less influence over the Middle East than Russia does. Obviously, the higher prices will allow Russia to sell oil at a higher price and therefore support their ongoing atrocious war.

The sad part about all this pain that we are suffering with inflation and higher interest rates all could be reversed tomorrow by the signing of a new bill. If the White House would call off this political and regulatory campaign against American oil and oil production, the price of oil would start to fall immediately. We would see an explosion in the exportation and production of oil, which would get us back to the energy independence we saw only 18 months ago.

|

| “Ava Rollins, do you have any homework?” |

It is difficult to explain why the equity markets have been so decimated in 2022 given the strong economic numbers that we have enjoyed. Plus, we have an extraordinarily long record of positive performance, and we now know that every single bear market has grown into a bull market in every downturn. Ever since 1928, the S&P 500 has fallen 20% or more on 21 separate occasions. That does not include the 2022 performance since it is not over yet. That means that on average, there is a bear market every 4.5 years. Yet, it has not only recovered from every single one of those slumps, but it has gone on to see positive returns and more.

Think about this for a second. In the last 19 years of the stock market performance, there have only been two negative years. Of course, we had the extraordinarily big loss in 2008 and the other loss was only marginally negative. If you were a gambling person and I gave you money to go to Las Vegas and I told you that if you bet 19 times, you would win 17 of those times, you would take that chance every single time. The odds of a major correction going forward seem absolutely and totally remote.

Let us look at the current performance. Based on the information we currently have available to us now and the forecast by the Federal Reserve of Atlanta, the GDP for the quarter ending September 30th should be pretty positive.

|

| Ziming Yu – Don’t make him angry! |

We know that there are more people working now than ever, and therefore, there are more people to spend in the economy and make it stronger. Think about this for a second; going into this quarter it is projected that the earnings will be 2.9% higher than the previous years' earnings. In my way of thinking, that makes these companies 2.9% more valuable than they were on January 1, 2022. If the companies are more valuable because the earnings are higher, why is the performance down 23.9%? Once again, I focus on the fact that there seems to be a coalition of traders who are determined not to allow this market to trade up. I have noticed that over the last 60 days that the last trade of the day, on any given day, is a highly negative one. Therefore, if the market does trade up a few percentage points during the day, those gains are essentially wiped out by one large block trade making it negative.

An example of an extreme swing in the market was when they announced the Consumer Price Index for the month of September on October 12, 2022. At 8:30 in the morning, the inflation report was published and was one-tenth of one percent higher than expected. Immediately the futures went from 300 up to 500 down. The market opened down 500 or 600 points almost immediately, but throughout the course of the day those losses turned into huge gains. The Dow Jones Industrial Average Index ended up over 800 points that day when it started out negative 500. So basically, the S&P 500 Index on that day fell 2.4% before finishing up 2.6%, a five-point percentage swing. This type of inner-day action has only happened nine times since 1983, according to Bespoke Investment Group data. Do you really think that the average investor is sitting there by their computer, trading a market with wild fluctuations on a given Wednesday? Do you understand how much money it would take to move the market by 1,500 points? Of course, as you would expect, later in the week, the market sold off, basically to neutralize that large swing. This type of trading is not for investors.

|

Mia and her dad Muzzie (95) spending some

father-daughter time at the game! |

Everyone is raising the question of whether the Federal Reserve is moving too quickly. I am a strong believer that the people in charge of the Federal Reserve are very well-educated and do see all the data. It has always been believed that if you have a rate increase, it will take as long as six to nine months before that rate increase takes effect in the economy. During 2022 alone, the Federal Reserve has already raised rates five times. The last three raises were more punishing increases of 75 basis points each. It is also forecasted now that they will increase interest rates by .75% in November and .5% in December. All of this is designed to get the Federal Funds Rate above 4% prior to the end of the year. The real mystery is that with all these increases within the last six months, have they been too much for the economy to absorb all at the same time?

I am one that would recommend that the Federal Reserve slow down and actually see whether these increases have actually done their work. I am in the camp of economist Dr. Jeremy Siegel who is now pronouncing that “the Federal Reserve has slammed the brakes way too far.” He is of the opinion that already the components leading to major inflation have been put in place. He is afraid, as am I, that the Federal Reserve is moving too quickly and not giving time to evaluate those increases. As he says, “most of the inflation is behind us, and the biggest threat is a recession, not inflation today.” He is arguing that the Federal Reserve might be doing more damage to the economy than good by raising rates and potentially forcing the economy into recession. No one knows exactly what the answer to that question is, but it certainly raises a legitimate concern.

|

| Patiently waiting for the market to rally… |

I often think to myself, is it the work of the government to destroy a strong economy? If we had this great economy back in 2019 prior to the Covid-19 downturn, all of us would feel good and happy and the Federal Reserve would be content on allowing the good times to continue. However, today, with an extraordinarily good economy and virtually full employment, there is a really bad attitude among American populists. I suspect more so than ever that this sentiment is leading to many of the strong negative feelings on Wall Street. Assuming that the Federal Reserve carries out its tasks and truly moves the economy from a 2.8% increase to a negative GDP, the net effect can only be that they will have to put 10 million people in America out of work. The only way we are going to get inflation under control is to reduce employment and reduce the profitability of businesses. Is it fair for the government to say to these families that they will no longer get a wage or health insurance or be able to meet their monthly bills? At the end of the day, which is worse, having some inflation or having 10 million people out of work in the U.S.?

My opinion is that we certainly want to reduce inflation going forward, but it is not as devastating to the economy as politicians seem to be making it. What would be devastating to me would be to force all these people out of work for no reason. Therefore, I join Dr. Siegel in saying that maybe it is time for the Federal Reserve to back off and slow down their increases until we have time to see how those increases will actually affect the economy.

|

| Joe, Drew, Mia and Shelley enjoying the Braves’ one win of the series! |

So, all the above was written under the full understanding that so far, the downturn in the stock market has been extraordinarily bad given the positive economic evidence. I cannot explain that downturn based on any reasonable market valuation. As previously mentioned, we have more people working in America than ever today. Do you think for a second that they will cut back on their iPhone usage? Do you think that going forward we will have less use of the internet and therefore affect Google’s earnings? If you own Microsoft, Microsoft is basically a monopoly around the world. Everything you touch has Microsoft’s name on it.

With more people working than ever and a 5% increase in salaries over the last year, do you really think fewer people will be using Microsoft? All of those assumptions are ridiculous. Could in fact the Ukrainian War get more out of hand and create harm to the American economy? Of course, that possibility exists. However, it looks like Ukraine is well along the way to shutting down the Russian military and negotiating a settlement to the war before the end of December 2022. The question is, are we going into a recession in 2023 due to the actions of the Federal Reserve?

I don’t believe that the Federal Reserve would ever purposely destroy the economy in an effort to reduce inflation. Remember, we are also in a political environment where the next Presidential election is only two years away. There is a high likelihood that Washington will turn over during the midterm elections, which I think would be a positive for the markets going forward. The markets seem to do best when the government does less.

|

| Long-time client Sookie Mitchem looking trés chic! |

So, my projection of the increase in stock prices depends on the actions of the Federal Reserve and the traders. If the Federal Reserve would announce some sort of cutback or slow down on interest rate increases, you would see remarkably increased stock prices. We now know from all economic evidence, there is no reasonable reason that the market has fallen 23.9% year-to-date. But I also know that all these numbers could turn on a dime if the Federal Reserve were to indicate a moderation. What we know from prior bear markets are that they can all literally change overnight without any warning. If you are not invested, you will not enjoy that increase.

We also know from prior experience that this is the buying opportunity of a lifetime for people not needing the money for 10 years or so. Stocks are trading at huge discounts and if you are a young investor not needing your money for 20 to 30 years, you should take this opportunity to up your investment for the future. For people near retirement, the biggest misconception is that they believe they will need all of their money on day one. As an example, if you retire at age 65 and you have a life expectancy of 25 years, why do you want 100% of your investment money to be conservative? If in 19 years you will only have two negative years, and if you keep a couple of years of cash reserves to pay distributions, the rest of the money should be invested. I am not sure when exactly the traders will change their minds.

|

| Drew Malone and his brother, Brock, lending a hand at the Falcons game! |

You may have recently noticed that the major brokerage houses were fined close to $1.8 billion for traders using their own personal phones during working hours. As you well know, the SEC closely scrutinizes phone calls and emails regarding investing. They have no authority over text messages. It came out that all the major brokerage houses were allowing their traders to text during working hours. I rather suspect that is just the first start of this coalition of traders trying to manipulate the market. They all move in one direction at a time. But that one direction can change immediately with communication. There will be a day shortly where those traders decide that it is time to buy and the move up will be significant and rapid. I do not know when that day is, but I do know that if you are not invested, you will not participate.

I fully recognize that this has been a difficult year and selling to cash would be the easiest thing that I could do. It would take 100% of the stress off of me and 100% of the stress off of you. The problem with that action is that as every financial book will tell you, you never try to time the market. If we go to cash, which is a simple action, to get reinvested is a difficult reaction. I would rather take the risk that we suffer some short-term losses in order to participate in long-term opportunities. I know it has been difficult, but you have to believe that the economics overrides the performance of the traders, and this year will eventually work out fine.

If you have an interest in coming down to visit with us, we look forward to seeing you. We are moving into a slower period for our Firm and will have the time to sit down and review your portfolio, taxes, or anything else you might be interested in.

As always, the foregoing includes my opinions, assumptions, and forecasts. It is perfectly possible that I am wrong.

Best Regards,

Joe Rollins

All investments carry a risk of loss, including the possible loss of principal. There is no assurance that any investment will be profitable.

This commentary contains forward-looking statements, which are provided to allow clients and potential clients the opportunity to understand our beliefs and opinions in respect of the future. These statements are not guarantees, and undue reliance should not be placed on them. Forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual results in future periods to differ materially from our expectations. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.