From the Desk of Joe Rollins

I took a break from writing the commentary that I normally write on a monthly basis. Tax season this year was extraordinarily hard and demanding. It seems every time that Congress decides to change the tax law and make it easier, our workload doubles. All the Covid-19 tax changes were designed to help taxpayers, but they put an undue burden on tax preparers. Tax returns have become so complex that it is virtually impossible to explain all the variations that come into play based on the simplification by Congress. Anyone who really thinks they can do their own tax return if it even has a minor degree of complexity is fooling themself. It takes vast computer capabilities to assess all the possibilities that are available. One of the things we know for sure is that if Congress continues to simplify the law, it will provide permanent long-term employment for CPA’s everywhere.

At the end of 2021, the S&P 500 Index had made 87% over the three previous years. These were three of the most outstanding total return years ever for this index. The same cannot be said for the first four months of the 2022 tax year. Basically, nothing positive can be said regarding the performance of those stocks and alternative investments. Even the bond index is down close to double digits year-to-date, and the selloff and volatility of the market is virtually breathtaking. I would have a high level of concern for the short-term future of the markets if I were not well versed on the actual economy and corporate earnings. A couple of things I would like to point out in this posting are the inconsistencies of what you hear on financial news and what are really the facts. You can make up all the extraordinarily screaming headlines regarding your opinions on equities and bonds, but I would rather focus on the actual numbers.

It pains me to even report the first four months results, but everyone needs to understand them. The Standard and Poor’s 500 Index is down 12.9% through the month of April 30, 2022. The one-year performance on this index is 0.2%. The NASDAQ Composite leads the charge down at -21% for the year 2022 and a one-year performance of -11.1%. The Dow Jones Industrial Average is down 8.7% for the year 2022 and down 0.8% for the one-year period then ended. If you thought you were going to get any type of relief investing in bonds the Bloomberg Barclays Aggregate Bond Index is down 9.4% for the year 2022 and down 8.6% for the one-year period then ended.

After reading those numbers, I guess you could form your own level of pessimism and turn negative on investing in financial assets. If you were to do so, it would certainly be a mistake. If you look at even a five-year time period including the one reported above, the S&P 500 Index is up annually 13.7%. The NASDAQ Composite with its lowly returns in 2022 is up 16.4% per year over the last five years. The Dow Jones Industrial Average’s up 12% for the last five years even though it is showing a negative one-year return. Once again, the Bloomberg Barclays Aggregate Bond Index is showing a lowly return of 1.2% for the five-year period and a significantly negative 2022. If you evaluate all the above information, you will unquestionably see bond investing is by far the least profitable of all the major market indexes.

I get the question almost every day from clients about what is really going on in Wall Street. It is not easy to explain when the economy is extraordinarily good, earnings are great and interest rates continue to be low. Why has the market suffered such severe losses over such a short period of time? There can only be one explanation that makes sense. The hedge funds and momentum traders have figured out that Chairman Powell and the Federal Reserve really have no clue what they are doing. They are so absolutely convinced that the Federal Reserve is going to increase interest rates to the point of throwing the country into recession and creating huge economic losses due to the recession.

When Chairman Powell announced that they were increasing interest rates by only 50 basis points, the Stock Market rallied up to close to 1,000 points. By only increasing interest rates by one-half percent, he took off the table that he would increase rates any faster. The very next day the market dropped over 1,000 points because the traders and the momentum machines decided that Chairman Powell was not aggressive enough to kill inflation. Which way do you really want it? Do you want a Federal Reserve that goes slowly and sees how the price increases affects the economy, or do you want to see the Federal Reserve slam on the brakes and shut the economy down to recession immediately? The hedge funds, professional traders and momentum machines are in the camp of the latter rather than the former. Those are not investors!

I had a client ask me the other day why this period was not like 2008 when the S&P 500 Index lost 38.5%. It is fairly obvious that either the client was not alive during 2008 or had not bothered to read the history of the financial markets during that time. If you compare 2008 to 2022, the results could not be more different. The unemployment rate in 2008 was 7.3%, in 2009 it was 9.9% and in 2010 it was 9.3%. The GDP in the fourth quarter, 2008 was down over 8%. We are talking about severe unemployment and a severe drop in GDP due to the financial crisis in 2008.

If you compare that with where we are in 2022, you can see the contrast. Unemployment remains at 3.6% which is virtually the lowest unemployment we have had ever in the history of U.S. finance other than in times of war. As of this writing there are job openings in the United States of 11,549,000 jobs. As of today, there are 5.94 million unemployed. You do not have to be a rocket scientist to figure out there are two jobs for every person unemployed in America. Anyone who wants a job can get a job and have their choice of jobs. In 2008, companies were closing daily, and tens of thousands of people were becoming unemployed immediately. We all recall banks closing, companies going out of business and financial crisis everywhere. Why is it that anyone would compare 2008 with 2022 that actually had the facts? How are the hedge funds, traders and machines trying to convince you that is exactly the case, even though the evidence is overwhelmingly something completely different?

Even though the traders and hedge funds would like you to believe that the country is leading to economic recession in 2022, there is very little evidence to support those outlandish claims. It is true the GDP was down roughly 1% in the first quarter of 2022, but remember that came after the year 2021 where the GDP was up 5.7%. Also, the first quarter GDP proclamation does not include inventory adjustments and I am willing to bet that as the adjusted GDP turns positive in the first quarter of 2022. Few people realize how much affect that weather has on the GDP. If the states up north cannot construct due to adverse weather conditions the GDP will suffer. Obviously, that is not the case beginning April 1st. When the entire U.S. is back to work.

But if you are really in the camp that the U.S. will go into recession in 2022 then you must be calling the U.S. Federal Reserve a bunch of liars. The projection for the GDP growth by the Federal Reserve in 2022 is 3.7%, which is a long way from recession. Even their projection for 2022 is a GDP growth of 2.3%. As you can see over the next 18 or so months, our Federal Reserve is not forecasting any recession as compared to the market makers that would like you to believe so.

What also is perplexing to people not truly understanding the movements of the market, is to believe that because the market is down so dramatically that there must be something emphatically wrong with the economy. If there is something wrong with the economy, then there certainly must be a reduction of corporate earnings coming up.

The evidence is in that for the first quarter of 2022, 80% of the reporting companies of the S&P 500 have exceeded their estimated earnings projections. Profits in the first quarter of 2022 are ahead 8.2% of the profits in the first quarter of 2021. The so-called experts have forecast an increase of 6.4% but earnings have far exceeded that, increasing to 8.2%. If there really is not a fall-off in the economy and not a fall-off in earnings, where does all the pessimism come from? Maybe there are just too many geopolitical events going on that have people totally confused. Yes, we have a war in Ukraine, yes, we have inflation, and China is still being extreme about COVID. All of those are certainly things that make you worried. However negative sentiment is not what drives stock prices higher. Stock prices are driven higher by the economy, earnings, and interest rates, not how negative you feel about the world in general.

It is really hard to believe why so many people misunderstand basic concepts of economics. Maybe after about 50 years of studying it, it seems simpler to me than to most. During the year 2021 we had 5.7% GDP growth - quite frankly that is too fast. We overstimulated the economy due to COVID-19 and we ended the year of 2021 with everyone having too much money to spend and too few places to spend it. As a practical matter we needed to slow the economy. Almost every day you read some sort of outrage regarding supply chain shortages. We cannot build enough cars, semi-conductors, produce enough oil or gas, we are basically just short on everything. While the newspapers would like for you to believe that this was a supply chain problem, in fact it was a demand problem rather than a supply problem. There was way too much demand for the available supply. How do you solve that problem? You slow the economy!

The way to slow the economy is relatively simple in monetary terms. If you increase interest rates, you crowd out the marginal borrower. Some people cannot afford homes because the interest rates have gone up, some people cannot afford cars because the interest rates have gone up and the combination of the two slows the marginal consumer and brings down GDP to a more sustainable level of three to four percent. As I mentioned earlier, the Federal Reserve projects that GDP for 2022 will be 3.7%, almost perfectly in the mid-cycle of the optimal GDP rates.

There is no question that we have inflation in the system, but every sign I see indicates that it has peaked and has started to fall. The current administration in Washington desires to have higher gasoline rates by its obnoxious and uninformed restriction of supply of crude oil. They got what they wanted, and prices have jumped up since the price of oil affects virtually every commodity. However, that price has stalled and at a higher price, more and more exportation is occurring. As we go forward into 2022, the fact that the price of oil has leveled out will reduce the cost of inflation going forward.

We also have just an avalanche of bad information either through the lack of knowledge or through the purpose to deceive. It really aggravates me when I read such blatant misstating of facts. Do you not find it interesting that the best performing sector in the market is of course the oil companies? As you would expect since the price of oil has basically doubled due to the President’s decrease in supply, the oil companies have recorded a record turnaround in stock prices. However, to think that they are the most profitable companies around borders on absurdity.

The most famous of these is ExxonMobil that showed profits in 2021 of an outstanding $23 billion. For the first quarter of 2022, ExxonMobil’s profits were $5.4 billion, once again, quite extraordinary. To put it in the upper echelon of performing companies, compare that fossil fuel company to a company that only makes gadgets. Apple had profits in 2021 of $94 billion, which is approximately four times the profits of ExxonMobil. During the first quarter of 2022, Apple had profits of $25 billion as compared to ExxonMobil’s $5.4 billion. As you can see, Apple far outpaces the profits of ExxonMobil. During the first four months of 2022, Exxon’s stock increased to 25% and Apple’s went down 18%. Duh!

Much was said back when President Trump decreased tax rates and how the revenue to the U.S. government would crash and burn creating huge and greater deficits. But actually look at the numbers, which I think are quite interesting. In the year 2017, which was the first full year of the Trump Presidency, tax revenues to the Federal Government was $1.76 trillion. In 2021, the amount of tax revenue was $2.04 trillion. As you can see revenue from individual income taxes was actually up and not down due to the tax decreases. The biggest complaint by the minority party at that time was that corporate taxes would be dramatically reduced due to these lower tax rates. In 2017 corporations paid $330.1 billion in taxes and in 2022 $371.8 billion in taxes. Once again, common thinking led to the wrong conclusions. As the current administration desires to increase taxes across the board for both individuals and for corporations, I guess they have not checked the above facts which irrevocably proves that decreasing taxes actually increases revenue.

While I am not a particularly big fan of Netflix, I do like to get the facts right. The Netflix stock is down 71% from its all-time high. On the day they reported their first quarter earnings, the stock dropped an unbelievable 43% in one day. It is hard to fathom that a stock as broadly based as Netflix can basically nosedive based on their earnings, but have you actually looked at those earnings? For the first quarter of 2022, Netflix had a net profit of approximately $1.6 billion. Did you realize that this is close to the highest earnings ever in the history of Netflix, but yet the stock dropped 43% in one day? I wonder who has actually tried to deceive you by misreporting the facts. I guess great earnings do not drive stocks higher.

The newspapers screamed that Amazon showed its’ first quarterly loss in over seven years. “What is wrong with Amazon that they cannot make a profit any longer?”, exclaimed the four-inch headlines in the Wall Street Journal. If you looked at the actual earnings report, you saw a completely different story. The profit from operations for Amazon for the first quarter of 2022 showed a profit of $3.6 billion. Pretty good by anybody’s standard. However, Amazon does own a significant interest in the startup electrical car manufacturer Rivian. In this quarterly report, they wrote down the investment in Rivian by $7.6 billion. Therefore, it is true that Amazon showed a loss of $3.8 billion for the quarter, but it was strictly smoke and mirrors. A book entry does not have the same effect as the loss of operations, which is a loss of cash. Those that reported a loss of operations in the financial press did you a disservice.

I am not trying to convince you of anything regarding the stock market other than the facts. The economy is nothing like what occurred in 2008 and there is almost zero chance of recession in 2022. Once again, the professional traders are playing you for the village idiot. Let’s see if we can scare the public out of these stocks so that we can buy them cheaper. If you are a long-term investor, you should cheer downturns like this. You can buy companies that will revolutionize our future at bargain basement prices. Why is it that every major professional money manager that manages growth mutual funds is down 25% or 30% this year? The simple reason is that growth is so out of favor that the traders are trying to hide you from the truth. All of that will change soon.

One of the interesting things that is going on at the current time is that the major companies are buying back their stock at record levels. Due to the enormous profits of the major companies, they cheer a downturn in the stocks so that they can buy it back cheaper. When you see buyback programs from $30 to $100 billion per year, you know that this is the truth. Also, we are going into a period where major stock splits will occur and such desirable companies such as Google and Amazon will be selling at a fraction of their current prices. While stock splits do not make companies more valuable, they do make them more available. You will see a mass buying spree in the stocks due to the availability of a lower share price.

As I guess you can gather from reading above, while the sell-off is concerning, it is less concerning to me because I know economic support for the stocks is everywhere. The economy will not fall through this year or next. The Federal Reserve will not do something stupid and throw the country in recession. Have you even considered that this year is an election year? The Federal Reserve’s intervention in interest rates to affect the election would be a political nightmare. You can rest assured that the Federal Reserve will stay away from any implication of a desire for either political party.

As I have said often, I still believe 2022 will be an up year just because the economy, earnings and interest rates support a higher close. It may look the opposite from where you are watching, but if you take the time to research the numbers, you will see they are supportive of higher stock prices. I have reviewed the correlation between unemployment and recession all the way back to the first day they started collecting this data. Never in the history of American finance has recession ever occurred with unemployment at 3.6%. How anyone could assert that be the case has clearly never looked at the economic history of the U.S.

As always, the foregoing includes my opinions, assumptions, and forecasts. It is perfectly possible that I am wrong.

Best Regards,

Joe Rollins

I took a break from writing the commentary that I normally write on a monthly basis. Tax season this year was extraordinarily hard and demanding. It seems every time that Congress decides to change the tax law and make it easier, our workload doubles. All the Covid-19 tax changes were designed to help taxpayers, but they put an undue burden on tax preparers. Tax returns have become so complex that it is virtually impossible to explain all the variations that come into play based on the simplification by Congress. Anyone who really thinks they can do their own tax return if it even has a minor degree of complexity is fooling themself. It takes vast computer capabilities to assess all the possibilities that are available. One of the things we know for sure is that if Congress continues to simplify the law, it will provide permanent long-term employment for CPA’s everywhere.

|

| Howdy! Artist Stevie Streck's rendition of Ava horseback riding |

At the end of 2021, the S&P 500 Index had made 87% over the three previous years. These were three of the most outstanding total return years ever for this index. The same cannot be said for the first four months of the 2022 tax year. Basically, nothing positive can be said regarding the performance of those stocks and alternative investments. Even the bond index is down close to double digits year-to-date, and the selloff and volatility of the market is virtually breathtaking. I would have a high level of concern for the short-term future of the markets if I were not well versed on the actual economy and corporate earnings. A couple of things I would like to point out in this posting are the inconsistencies of what you hear on financial news and what are really the facts. You can make up all the extraordinarily screaming headlines regarding your opinions on equities and bonds, but I would rather focus on the actual numbers.

It pains me to even report the first four months results, but everyone needs to understand them. The Standard and Poor’s 500 Index is down 12.9% through the month of April 30, 2022. The one-year performance on this index is 0.2%. The NASDAQ Composite leads the charge down at -21% for the year 2022 and a one-year performance of -11.1%. The Dow Jones Industrial Average is down 8.7% for the year 2022 and down 0.8% for the one-year period then ended. If you thought you were going to get any type of relief investing in bonds the Bloomberg Barclays Aggregate Bond Index is down 9.4% for the year 2022 and down 8.6% for the one-year period then ended.

|

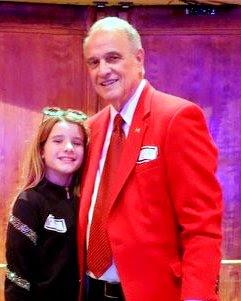

| The future is looking pretty bright! Congrats Marti and Mitch! Mia Musciano-Howard's children |

After reading those numbers, I guess you could form your own level of pessimism and turn negative on investing in financial assets. If you were to do so, it would certainly be a mistake. If you look at even a five-year time period including the one reported above, the S&P 500 Index is up annually 13.7%. The NASDAQ Composite with its lowly returns in 2022 is up 16.4% per year over the last five years. The Dow Jones Industrial Average’s up 12% for the last five years even though it is showing a negative one-year return. Once again, the Bloomberg Barclays Aggregate Bond Index is showing a lowly return of 1.2% for the five-year period and a significantly negative 2022. If you evaluate all the above information, you will unquestionably see bond investing is by far the least profitable of all the major market indexes.

I get the question almost every day from clients about what is really going on in Wall Street. It is not easy to explain when the economy is extraordinarily good, earnings are great and interest rates continue to be low. Why has the market suffered such severe losses over such a short period of time? There can only be one explanation that makes sense. The hedge funds and momentum traders have figured out that Chairman Powell and the Federal Reserve really have no clue what they are doing. They are so absolutely convinced that the Federal Reserve is going to increase interest rates to the point of throwing the country into recession and creating huge economic losses due to the recession.

|

| Caroline anxiously awaiting her First Holy Communion! |

When Chairman Powell announced that they were increasing interest rates by only 50 basis points, the Stock Market rallied up to close to 1,000 points. By only increasing interest rates by one-half percent, he took off the table that he would increase rates any faster. The very next day the market dropped over 1,000 points because the traders and the momentum machines decided that Chairman Powell was not aggressive enough to kill inflation. Which way do you really want it? Do you want a Federal Reserve that goes slowly and sees how the price increases affects the economy, or do you want to see the Federal Reserve slam on the brakes and shut the economy down to recession immediately? The hedge funds, professional traders and momentum machines are in the camp of the latter rather than the former. Those are not investors!

I had a client ask me the other day why this period was not like 2008 when the S&P 500 Index lost 38.5%. It is fairly obvious that either the client was not alive during 2008 or had not bothered to read the history of the financial markets during that time. If you compare 2008 to 2022, the results could not be more different. The unemployment rate in 2008 was 7.3%, in 2009 it was 9.9% and in 2010 it was 9.3%. The GDP in the fourth quarter, 2008 was down over 8%. We are talking about severe unemployment and a severe drop in GDP due to the financial crisis in 2008.

If you compare that with where we are in 2022, you can see the contrast. Unemployment remains at 3.6% which is virtually the lowest unemployment we have had ever in the history of U.S. finance other than in times of war. As of this writing there are job openings in the United States of 11,549,000 jobs. As of today, there are 5.94 million unemployed. You do not have to be a rocket scientist to figure out there are two jobs for every person unemployed in America. Anyone who wants a job can get a job and have their choice of jobs. In 2008, companies were closing daily, and tens of thousands of people were becoming unemployed immediately. We all recall banks closing, companies going out of business and financial crisis everywhere. Why is it that anyone would compare 2008 with 2022 that actually had the facts? How are the hedge funds, traders and machines trying to convince you that is exactly the case, even though the evidence is overwhelmingly something completely different?

Even though the traders and hedge funds would like you to believe that the country is leading to economic recession in 2022, there is very little evidence to support those outlandish claims. It is true the GDP was down roughly 1% in the first quarter of 2022, but remember that came after the year 2021 where the GDP was up 5.7%. Also, the first quarter GDP proclamation does not include inventory adjustments and I am willing to bet that as the adjusted GDP turns positive in the first quarter of 2022. Few people realize how much affect that weather has on the GDP. If the states up north cannot construct due to adverse weather conditions the GDP will suffer. Obviously, that is not the case beginning April 1st. When the entire U.S. is back to work.

|

| The Schultz Family looking sharp! |

But if you are really in the camp that the U.S. will go into recession in 2022 then you must be calling the U.S. Federal Reserve a bunch of liars. The projection for the GDP growth by the Federal Reserve in 2022 is 3.7%, which is a long way from recession. Even their projection for 2022 is a GDP growth of 2.3%. As you can see over the next 18 or so months, our Federal Reserve is not forecasting any recession as compared to the market makers that would like you to believe so.

What also is perplexing to people not truly understanding the movements of the market, is to believe that because the market is down so dramatically that there must be something emphatically wrong with the economy. If there is something wrong with the economy, then there certainly must be a reduction of corporate earnings coming up.

The evidence is in that for the first quarter of 2022, 80% of the reporting companies of the S&P 500 have exceeded their estimated earnings projections. Profits in the first quarter of 2022 are ahead 8.2% of the profits in the first quarter of 2021. The so-called experts have forecast an increase of 6.4% but earnings have far exceeded that, increasing to 8.2%. If there really is not a fall-off in the economy and not a fall-off in earnings, where does all the pessimism come from? Maybe there are just too many geopolitical events going on that have people totally confused. Yes, we have a war in Ukraine, yes, we have inflation, and China is still being extreme about COVID. All of those are certainly things that make you worried. However negative sentiment is not what drives stock prices higher. Stock prices are driven higher by the economy, earnings, and interest rates, not how negative you feel about the world in general.

It is really hard to believe why so many people misunderstand basic concepts of economics. Maybe after about 50 years of studying it, it seems simpler to me than to most. During the year 2021 we had 5.7% GDP growth - quite frankly that is too fast. We overstimulated the economy due to COVID-19 and we ended the year of 2021 with everyone having too much money to spend and too few places to spend it. As a practical matter we needed to slow the economy. Almost every day you read some sort of outrage regarding supply chain shortages. We cannot build enough cars, semi-conductors, produce enough oil or gas, we are basically just short on everything. While the newspapers would like for you to believe that this was a supply chain problem, in fact it was a demand problem rather than a supply problem. There was way too much demand for the available supply. How do you solve that problem? You slow the economy!

|

| Ava enjoying the fact she's almost as tall as Carter and coming for Josh |

The way to slow the economy is relatively simple in monetary terms. If you increase interest rates, you crowd out the marginal borrower. Some people cannot afford homes because the interest rates have gone up, some people cannot afford cars because the interest rates have gone up and the combination of the two slows the marginal consumer and brings down GDP to a more sustainable level of three to four percent. As I mentioned earlier, the Federal Reserve projects that GDP for 2022 will be 3.7%, almost perfectly in the mid-cycle of the optimal GDP rates.

There is no question that we have inflation in the system, but every sign I see indicates that it has peaked and has started to fall. The current administration in Washington desires to have higher gasoline rates by its obnoxious and uninformed restriction of supply of crude oil. They got what they wanted, and prices have jumped up since the price of oil affects virtually every commodity. However, that price has stalled and at a higher price, more and more exportation is occurring. As we go forward into 2022, the fact that the price of oil has leveled out will reduce the cost of inflation going forward.

We also have just an avalanche of bad information either through the lack of knowledge or through the purpose to deceive. It really aggravates me when I read such blatant misstating of facts. Do you not find it interesting that the best performing sector in the market is of course the oil companies? As you would expect since the price of oil has basically doubled due to the President’s decrease in supply, the oil companies have recorded a record turnaround in stock prices. However, to think that they are the most profitable companies around borders on absurdity.

The most famous of these is ExxonMobil that showed profits in 2021 of an outstanding $23 billion. For the first quarter of 2022, ExxonMobil’s profits were $5.4 billion, once again, quite extraordinary. To put it in the upper echelon of performing companies, compare that fossil fuel company to a company that only makes gadgets. Apple had profits in 2021 of $94 billion, which is approximately four times the profits of ExxonMobil. During the first quarter of 2022, Apple had profits of $25 billion as compared to ExxonMobil’s $5.4 billion. As you can see, Apple far outpaces the profits of ExxonMobil. During the first four months of 2022, Exxon’s stock increased to 25% and Apple’s went down 18%. Duh!

|

| Where in the world did CiCi go? |

Much was said back when President Trump decreased tax rates and how the revenue to the U.S. government would crash and burn creating huge and greater deficits. But actually look at the numbers, which I think are quite interesting. In the year 2017, which was the first full year of the Trump Presidency, tax revenues to the Federal Government was $1.76 trillion. In 2021, the amount of tax revenue was $2.04 trillion. As you can see revenue from individual income taxes was actually up and not down due to the tax decreases. The biggest complaint by the minority party at that time was that corporate taxes would be dramatically reduced due to these lower tax rates. In 2017 corporations paid $330.1 billion in taxes and in 2022 $371.8 billion in taxes. Once again, common thinking led to the wrong conclusions. As the current administration desires to increase taxes across the board for both individuals and for corporations, I guess they have not checked the above facts which irrevocably proves that decreasing taxes actually increases revenue.

While I am not a particularly big fan of Netflix, I do like to get the facts right. The Netflix stock is down 71% from its all-time high. On the day they reported their first quarter earnings, the stock dropped an unbelievable 43% in one day. It is hard to fathom that a stock as broadly based as Netflix can basically nosedive based on their earnings, but have you actually looked at those earnings? For the first quarter of 2022, Netflix had a net profit of approximately $1.6 billion. Did you realize that this is close to the highest earnings ever in the history of Netflix, but yet the stock dropped 43% in one day? I wonder who has actually tried to deceive you by misreporting the facts. I guess great earnings do not drive stocks higher.

The newspapers screamed that Amazon showed its’ first quarterly loss in over seven years. “What is wrong with Amazon that they cannot make a profit any longer?”, exclaimed the four-inch headlines in the Wall Street Journal. If you looked at the actual earnings report, you saw a completely different story. The profit from operations for Amazon for the first quarter of 2022 showed a profit of $3.6 billion. Pretty good by anybody’s standard. However, Amazon does own a significant interest in the startup electrical car manufacturer Rivian. In this quarterly report, they wrote down the investment in Rivian by $7.6 billion. Therefore, it is true that Amazon showed a loss of $3.8 billion for the quarter, but it was strictly smoke and mirrors. A book entry does not have the same effect as the loss of operations, which is a loss of cash. Those that reported a loss of operations in the financial press did you a disservice.

|

| Always has time for her Dad... |

I am not trying to convince you of anything regarding the stock market other than the facts. The economy is nothing like what occurred in 2008 and there is almost zero chance of recession in 2022. Once again, the professional traders are playing you for the village idiot. Let’s see if we can scare the public out of these stocks so that we can buy them cheaper. If you are a long-term investor, you should cheer downturns like this. You can buy companies that will revolutionize our future at bargain basement prices. Why is it that every major professional money manager that manages growth mutual funds is down 25% or 30% this year? The simple reason is that growth is so out of favor that the traders are trying to hide you from the truth. All of that will change soon.

One of the interesting things that is going on at the current time is that the major companies are buying back their stock at record levels. Due to the enormous profits of the major companies, they cheer a downturn in the stocks so that they can buy it back cheaper. When you see buyback programs from $30 to $100 billion per year, you know that this is the truth. Also, we are going into a period where major stock splits will occur and such desirable companies such as Google and Amazon will be selling at a fraction of their current prices. While stock splits do not make companies more valuable, they do make them more available. You will see a mass buying spree in the stocks due to the availability of a lower share price.

|

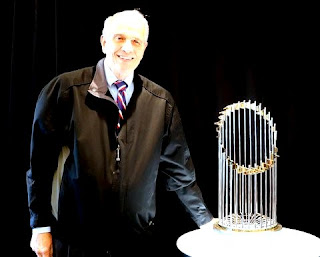

| Waited a long 26 years for this... The last time the Braves won was 1995 |

As I guess you can gather from reading above, while the sell-off is concerning, it is less concerning to me because I know economic support for the stocks is everywhere. The economy will not fall through this year or next. The Federal Reserve will not do something stupid and throw the country in recession. Have you even considered that this year is an election year? The Federal Reserve’s intervention in interest rates to affect the election would be a political nightmare. You can rest assured that the Federal Reserve will stay away from any implication of a desire for either political party.

As I have said often, I still believe 2022 will be an up year just because the economy, earnings and interest rates support a higher close. It may look the opposite from where you are watching, but if you take the time to research the numbers, you will see they are supportive of higher stock prices. I have reviewed the correlation between unemployment and recession all the way back to the first day they started collecting this data. Never in the history of American finance has recession ever occurred with unemployment at 3.6%. How anyone could assert that be the case has clearly never looked at the economic history of the U.S.

As always, the foregoing includes my opinions, assumptions, and forecasts. It is perfectly possible that I am wrong.

Best Regards,

Joe Rollins

“All investments carry a risk of loss, including the possible loss of principal. There is no assurance that any investment will be profitable.”

“This commentary contains forward-looking statements, which are provided to allow clients and potential clients the opportunity to understand our beliefs and opinions in respect of the future. These statements are not guarantees and undue reliance should not be placed on them. Forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual results in future periods to differ materially from our expectations. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements.”

No comments:

Post a Comment